Bi-weekly brokerage analysis

The sale of 72m Stella Maris is the highlight of the last two weeks in the brokerage sector…

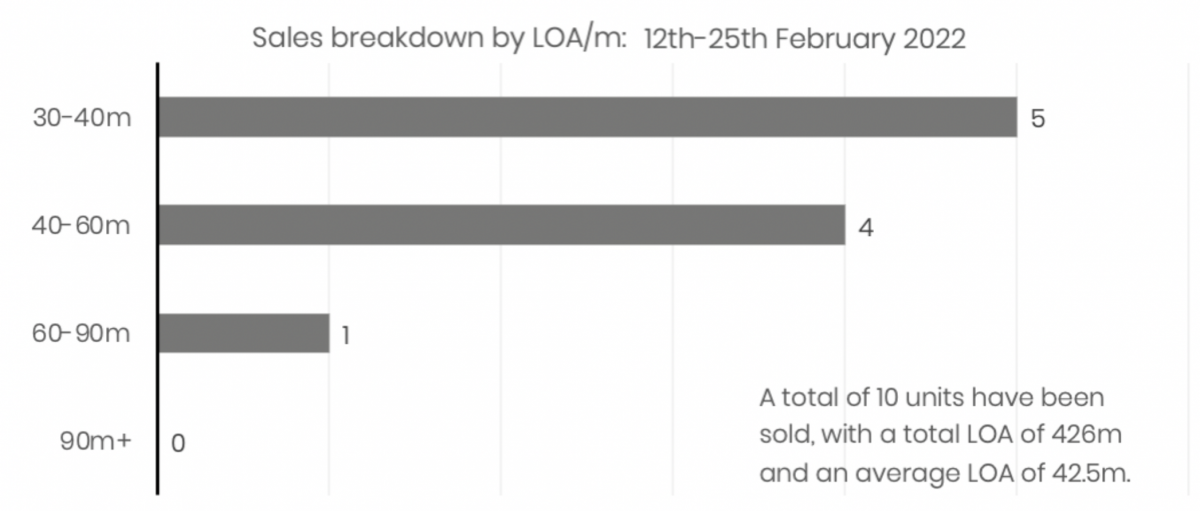

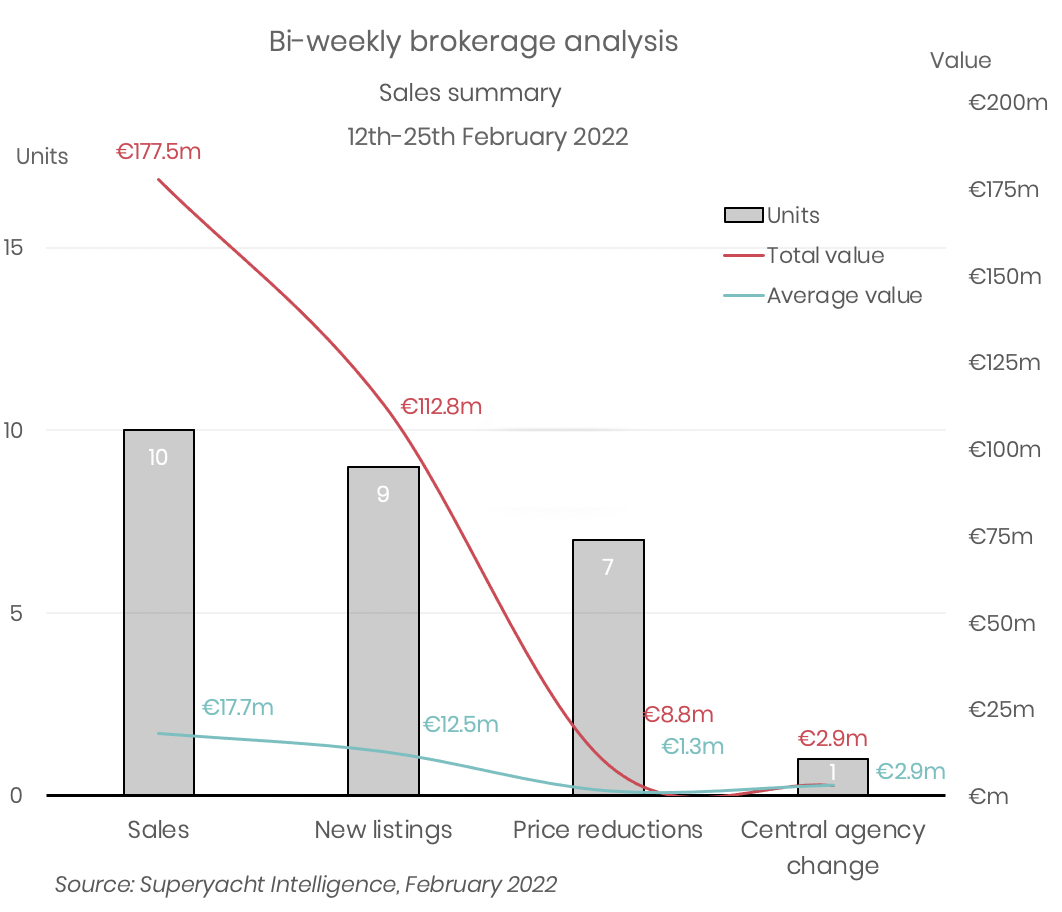

Data that has been provided by The Superyacht Agency shows that 10 units over 30m have been sold between the 11-25 of February. The total LOA of sales as well as the average value of the yachts sold have all increased since our last brokerage update a fortnight ago.

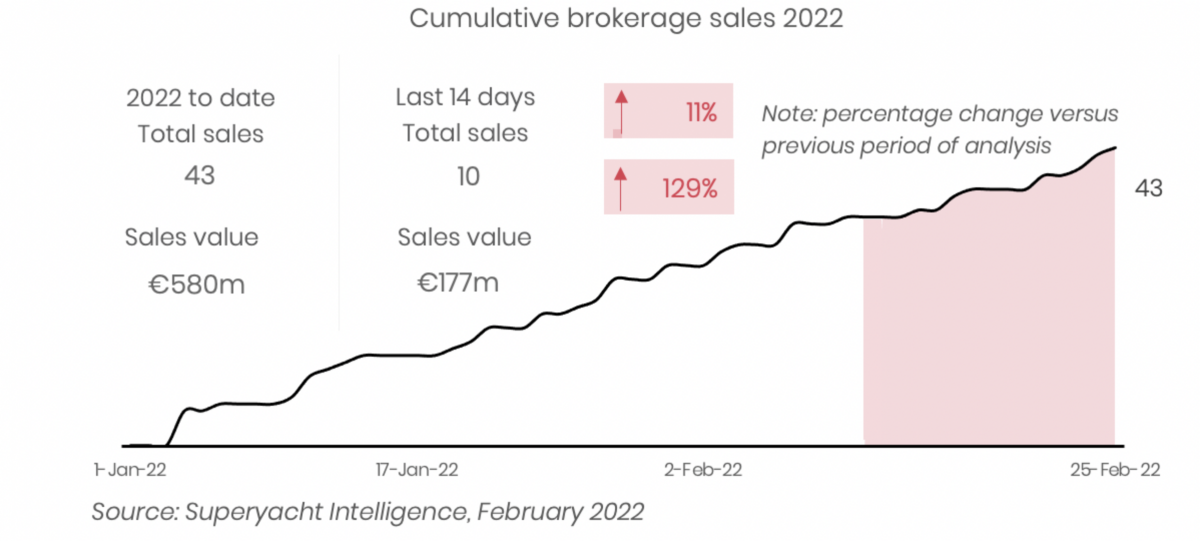

The total sale of superyachts over 30m in LOA since the start of 2022 has now surpassed half a billion (€580m). There has been a total of 43 superyachts sold since the 1st of Januray and ten of those have landed between 11-25 of February. What's more is that the same time period accounts for 30% of the sales value in the brokerage sector for the year so far.

The highest-grossing sale and also the largest yacht sold was the 2013 VSY-built Stella Maris, which has a last known asking price of €75m and LOA(m) of 72.1m. The yacht features a striking exterior profiling by famous designer Espen Øeino. Without the sale of Stella Maris the bi-weekly analysis of the brokerage market would show a relatively stark fall in the market activity. Royal Falcon One, the 41.4m Kockums delivered in 2019, had the highest price reduction at €4m.

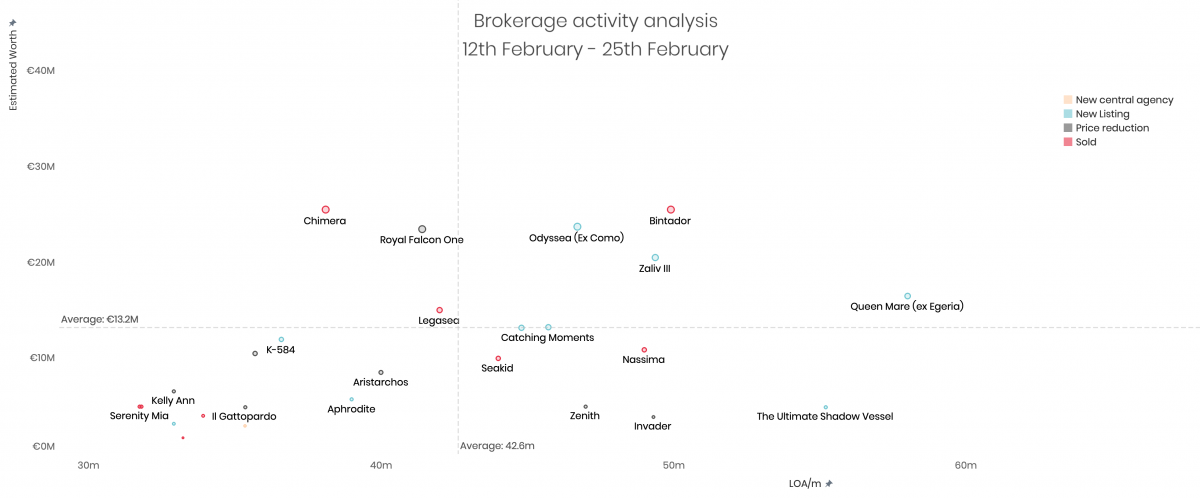

The two biggest new listings were Egeria's Queen Mare, and De Hoop's The Ultimate Shadow Vessel, at 58m and 55.2m respectively. Queen Mare has been listed at €16.5m whilst The Ultimate Shadow Vessel is listed at €4.9m. Just one yacht switched brokerage house, with Crescent's Unbridled moving to Merle Wood & Associates, now asking €2.9m.

While the graph shows the market is gaining speed and momentum, it should also be noted that the striking percentage increases are so high largely because of the fact that there is such a small sample size at play.

The graph below reveals all the movements within the brokerage market for the period analysed for boats below 70m in length. For reference, the red dots represent sales, blue new listings, grey price reductions, and salmon pink new central agencies, with the size of each point representing estimated value. Stella Maris was removed from the graph to ensure the bulk of the market was visible, such was the difference in value between this sale and the other market movers for this period.

The data provided within this article is just a snapshot of the data curated and available to The Superyacht Agency through its intelligence and consultancy offerings. By breaking down the data into more nuanced metrics and overlaying it with independent data sets, all of a sudden the market can be viewed in a much more colourful and detailed manner, enabling data to become intelligent and inform business-critical decisions. To find out more about how The Superyacht Agency can help your business, click here.

72.10m 13.50m 3.70m 2114

Espen Oeino International

Michela Reverberi

Laurent Giles Superyacht Architecture

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Sunseeker secure £30m at Miami Boat Show

Several future orders were also confirmed and negotiations for new models are underway...

Business

Where only superlatives count

Why homogenised language is a by-product of high standards and few limitations

Business

Resetting the lifecycle curve

How can we create a new lifecycle curve with the right kind of investment?

Business

Bi-weekly brokerage analysis

While numbers of sales and combined value have fallen, the brokerage market continues to perform admirably

Fleet

A token gesture

How the tokenisation of physical assets on the blockchain is changing the superyacht transaction landscape

Owner

Related news

Sunseeker secure £30m at Miami Boat Show

4 years ago

Where only superlatives count

4 years ago

Resetting the lifecycle curve

4 years ago

Bi-weekly brokerage analysis

4 years ago

A token gesture

4 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek