Sanlorenzo to acquire Perini Navi

Sources indicate Sanlorenzo is on the brink of completing the acquisition…

It seems increasingly likely, that Sanlorenzo, which began trading on the Milan stock exchange in December 2019, is on the brink of acquiring a controlling stake in Perini Navi, which currently has the Tabacchi family’s Fenix Srl as its main shareholder.

Reports in Milano Finanza suggest that, in order to resolve Perini Navi’s well-documented financial situation, the yard will activate business article 182 (according to Class Editori) and begin the restructuring of its debt as stipulated by its creditors. Once the debts are restructured, it is expected that a new parent company will be established with Sanlorenzo controlling 70 per cent of the shares and contributing €30 million to the financing of the operation. The Tabacchi family is expected to own 30 per cent of the shipyard and contribute a further €10 million to its development.

While, at the time of writing, the acquisition was not officially confirmed, sources from both parties have separately confirmed to SuperyachtNews that the deal is done.

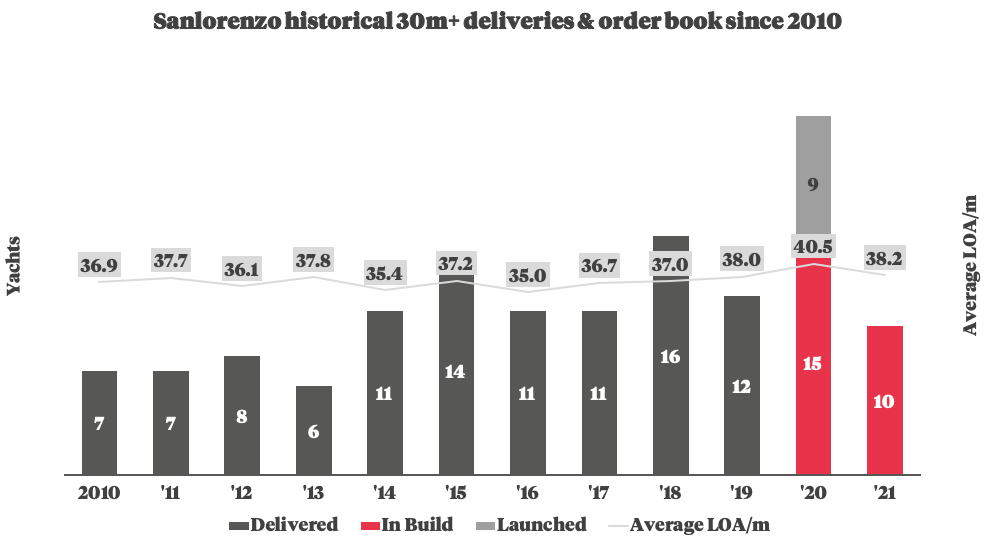

According to The Superyacht Agency, since 2010 Sanlorenzo has delivered a total 103 superyacht projects at an average of 10.3 units per year. According to the yard’s order book, there is a further 24 deliveries scheduled in 2020, which would mean Sanlorenzo starts the new decade with by far its strongest year to date. However, given that the delivery schedule will have faced unprecedented challenges from the Covid-19 crisis, alongside the fact our data shows that around 25 per cent of the orderbook at the beginning of any given year fails to be delivered, we can expect that this figure will be closer to 18.

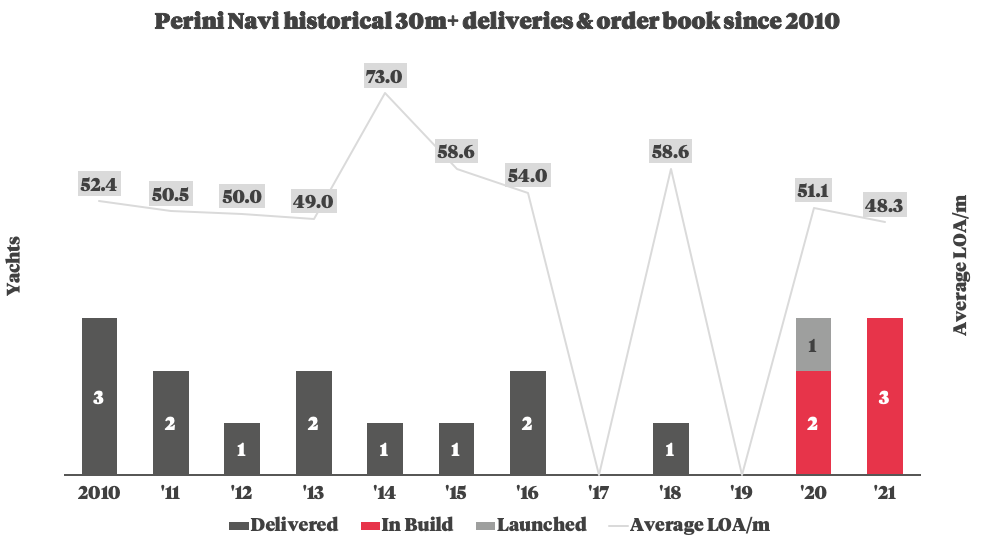

In contrast to Sanlorenzo’s strong delivery and order book figures, Perini Navi has only delivered a single project since it was acquired by the Tabacchi family in 2017. That being said, it has three projects scheduled for delivery in 2020 and three further projects due for delivery in 2021. While we can assume that these delivery schedules have been negatively affected by the crisis too and perhaps compounded by Perini Navi’s poor financial position, the brand’s strong legacy, excellent reputation for quality and key position within a niche sailing yacht market, make it an attractive proposition to potential investors.

Profile links

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Princess Yachts outperforming initial predictions

Princess Yachts’ retail performance in May 2020 outstrips 2019

Business

Shipyard status update: Pendennis

Joint MD Toby Allies outlines how the shipyard is operating under new conditions and looks to the year ahead

Business

Heesen Yachts launches YN 19055 Project Castor

The vessel remains on schedule for her delivery in August

Fleet

Shipyard status update: Rosetti Superyachts

New lease of life as the yard springs back into action

Business

The Italian Sea Group signs loan agreement

The Italian Sea Group signs loan agreement of up to 20 million euros with UniCredit and Deutsche Bank

Business

Related news

Shipyard status update: Pendennis

6 years ago

Heesen Yachts launches YN 19055 Project Castor

6 years ago

Shipyard status update: Rosetti Superyachts

6 years ago

Shipyard status update: Tankoa Yachts

6 years ago

The Italian Sea Group signs loan agreement

6 years ago

Yachting Developments delivers 34m ‘Al Duhail’

6 years ago

Shipyard status update: Savannah Yacht Center

6 years ago

Not just a billionaire’s toy

6 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek