The quintessential young owner

Does the data back up our assumptions about younger owners with support vessels?

In order to present its idealised view of the present and the future, the superyacht market often relies on a relatively fixed set of assumptions. In recent years, much has been said about evolving buyer values and demands, especially where this relates to young (relatively speaking), US-based tech entrepreneurs and how they are choosing to use their superyachts. In order to ascertain how accurate the market’s assumptions are, The Superyacht Agency has analysed the migratory and fleet data of a 40-50-year-old US-based tech billionaire that owns three superyachts, including a Damen Yachting Support Vessel, to explore whether or not usage patterns have genuinely changed to the extent that the industry professes.

Firstly, it would be useful to outline some of the assumptions that the industry makes about such owners. If the rhetoric is to be believed, owners that fit the description of the owner analysed herein are typically expected to be more adventurous than the average owner and far more inclined to add sustainable elements to their build projects. Much also has been discussed about the many and varied benefits of support vessels and how they enable owners to get off the beaten track and explore the world’s more rarefied locations with the benefit of additional toys and perspectives.

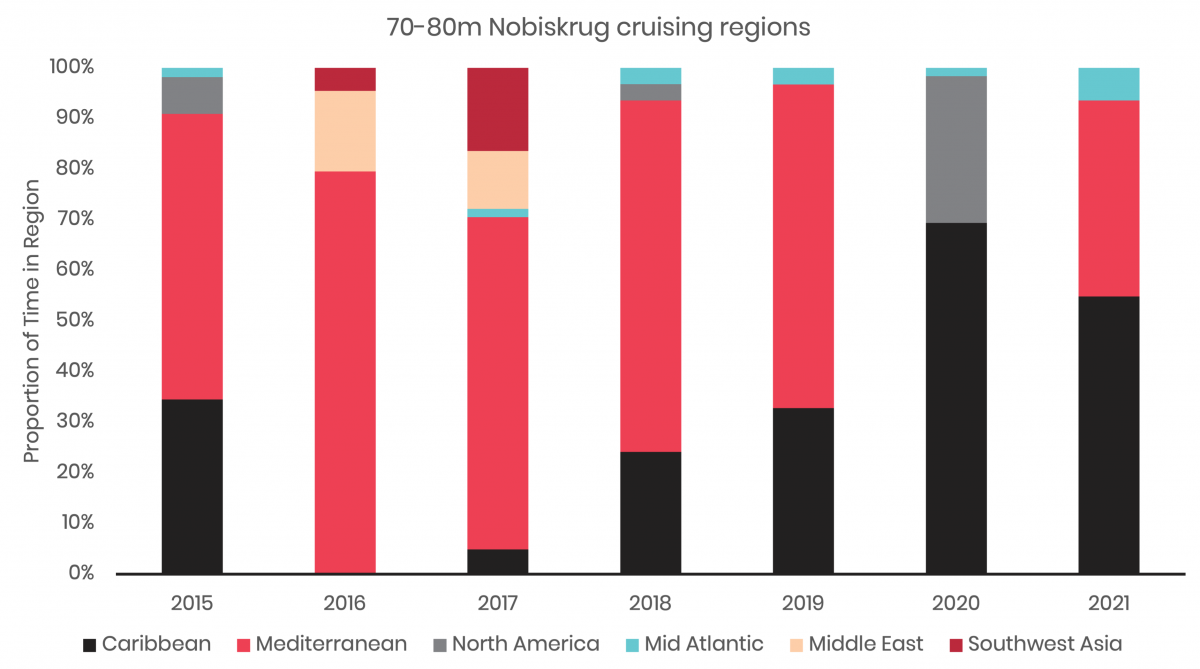

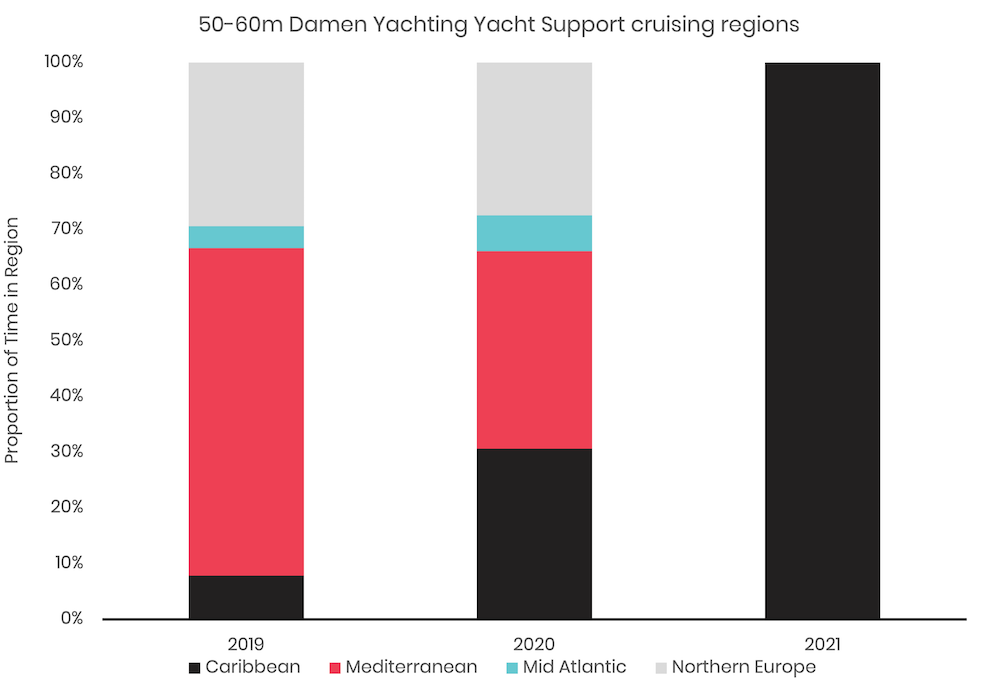

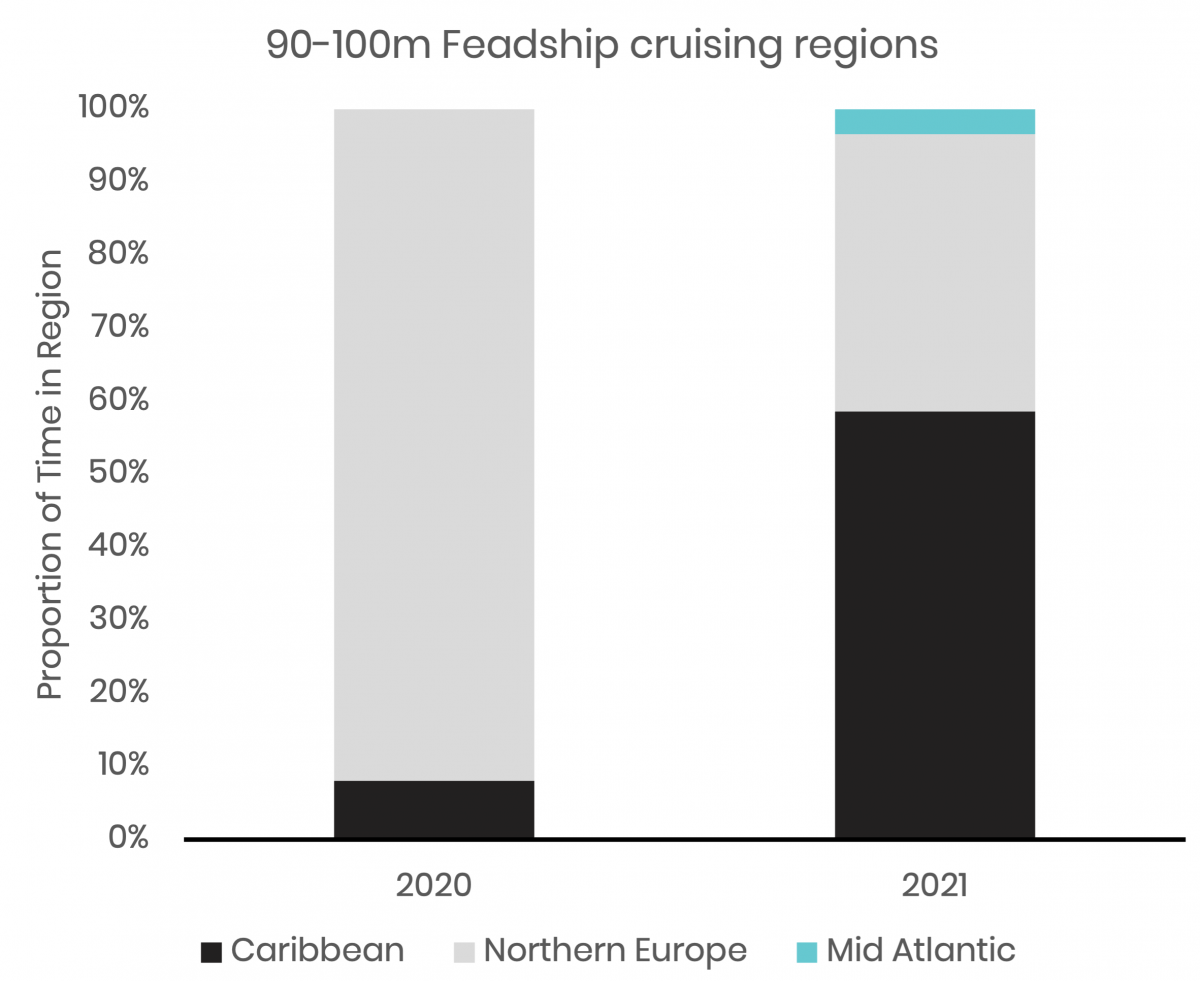

For context, the owner analysed within this article owns a 70-80m Nobiskrug, a 50-60m Damen Yachting Yacht Support and a 90-100m Feadship. The limited migration data available for the latter two projects reflect the vessels’ delivery dates, the Nobiskrug is occasionally offered for charter in the Caribbean.

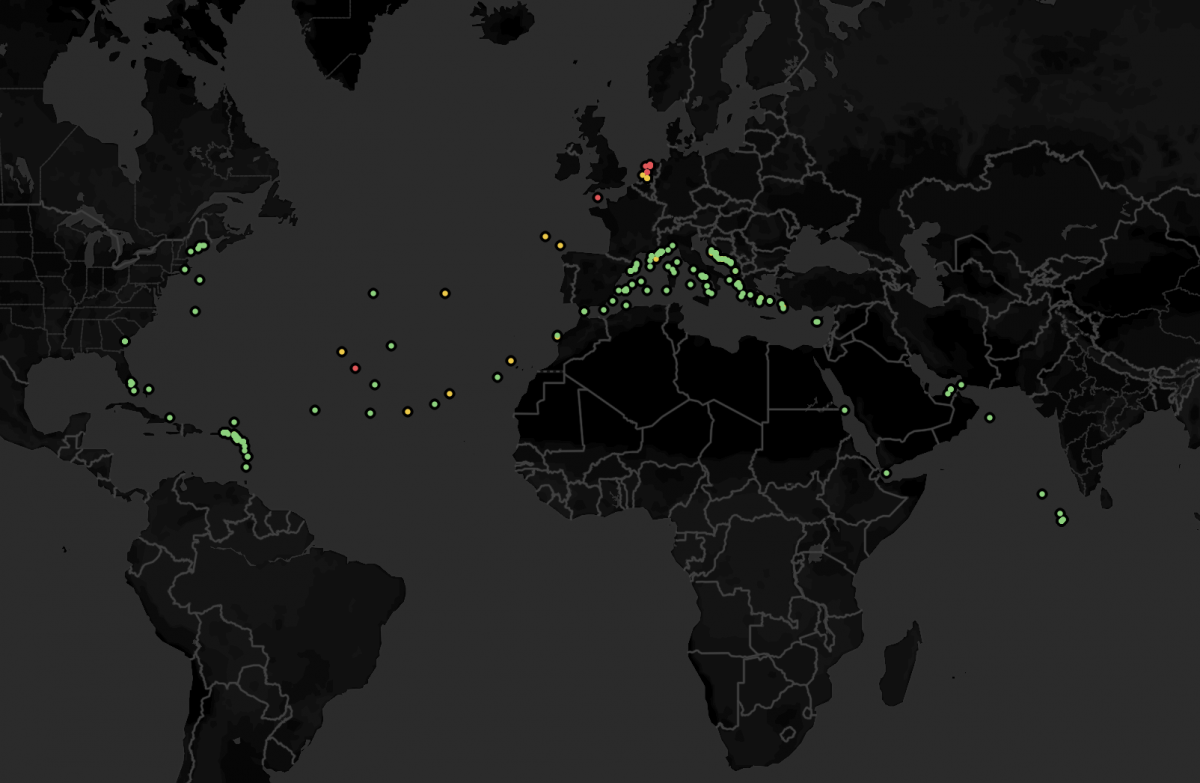

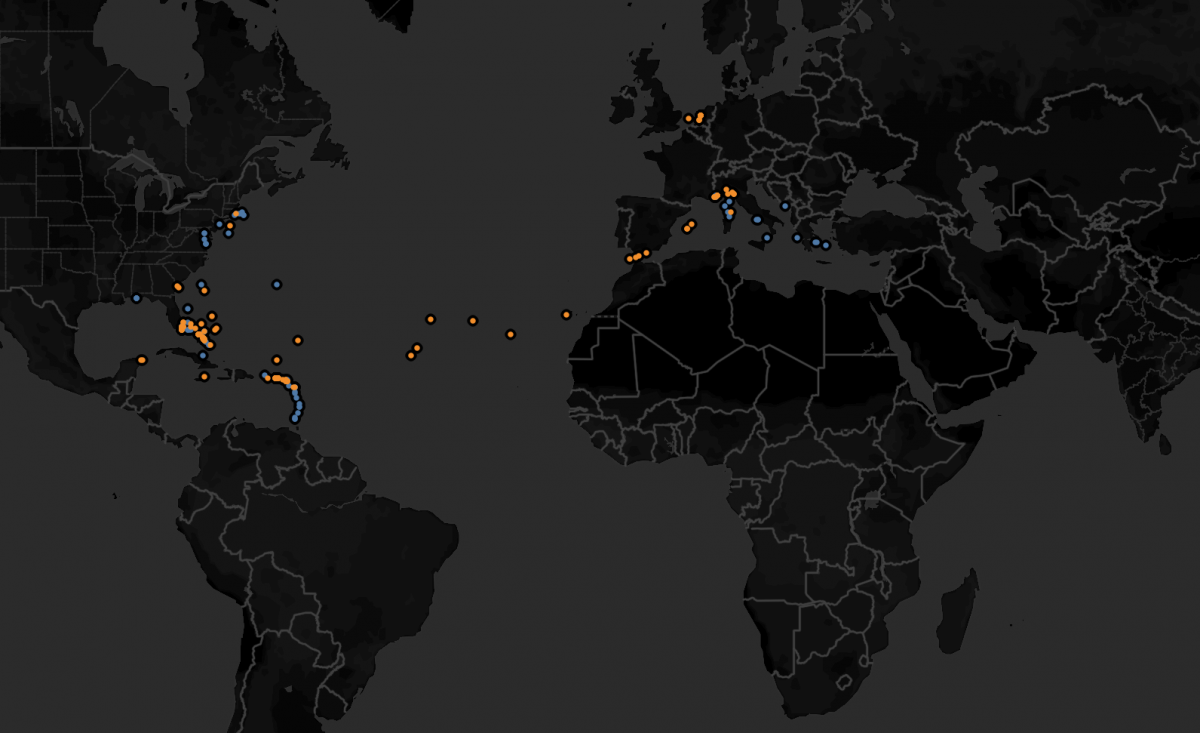

The migratory image above provides a snapshot of activity across the three vessels owned by the same owner. What is clear from the outset is that in reality the owner, regardless of the fact that they own multiple vessels and a support yacht, has barely diverged from the industry’s tried and tested stomping grounds. Indeed, arguably the most adventurous locations visited by the owner have been New England, the Maldives and Dubai, which are hardly new to the superyachting ecosystem.

The three graphs highlight the percentage of time that each superyacht has spent in a region whilst cruising. Unsurprisingly, and contrary to what certain factions of the market would have us believe, the vast majority of the time spent by all the vessels has been either in the Mediterranean or in the Caribbean. Due to the Feadship having been delivered in 2020, a large portion of time was spent in Northern Europe, however, when cruising became available, it headed straight to the Caribbean.

These observations in and of themselves are by no means damning, it just shows that this particular owner’s favourite locations happen to be some of the more obvious superyacht haunts. However, it does suggest that the marketing rhetoric that is being pushed out by the industry at large is slightly misrepresenting the operational reality for most contemporary owners and the extent of the 'adventurous spirit', especially where support vessels are concerned. The Damen Yachting Yacht Support is an absolute workhorse and it is capable of tackling almost any environment, and yet this one has only been used in the Mediterranean and Caribbean.

The Superyacht Agency can provide countless case studies of multiple yacht owners and, while some do diverge from the typical milk run, unfortunately, the vast majority continue to stick to the status quo, and the same is true of single superyacht owners. The below migratory map shows the usage profile for the owner of both a 50-60m Feadship and 30-40m Benetti. In this instance the owner doesn’t even adventure as far as Dubai or the Maldives, sticking rigidly to the milk run.

As stated previously, how owners choose to use their vessels is of no real consequence, however, it does highlight that the superyacht industry is perhaps failing in terms of its ability to highlight and sell into the full breadth of available superyacht experiences. There are, of course, outliers, vessels that travel to weird and wonderful places around the world, but these vessels are in such a small minority that they should not be spoken of in terms of trends. Nevertheless, these vessels and far-flung destinations make up for an overlarge portion of marketing materials and communications.

The exploration concept has been proved, but the data suggests that most owners are content to stick to the milk run, begging the question, is the market selling into an experience that most owners and guests simply aren’t that interested in? It should further be noted that none of the propulsion systems onboard our case study’s vessels are hybrid.

The above case study is just a small snapshot of The Superyacht Agency’s capabilities. By overlaying various data sets, The Superyacht Agency is able to create accurate pictures of various industry sectors. To find out more about the full suite of services available from The Superyacht Agency, including its rapidly growing consultancy offering, click here.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Asia Global Yachting to accept cryptocurrency

AGY has partnered with Bitkub to allow crypto payments for all of its services

Owner

The real state of the superyacht and UHNW sectors

Day One of The Superyacht Forum Live kicked off with a review of key UHNW sectors, as well as exploring how sustainable the market’s performance is

Business

The Superyacht Forum is on!

Following clarification on Covid-19 rules from the Dutch government, TSF will go ahead as planned

Business

GT-based reinvestment programme for ocean conversation

16 shipyards have committed to contributing €1 per gross ton that they deliver in 2021, others are due to follow

Business

The Superyacht Forum Live - Day Two

Day Two of The Forum will dynamically discuss issues ranging from alternative fuels to immersive owner experiences

Technology

Related news

Asia Global Yachting to accept cryptocurrency

4 years ago

The Superyacht Forum is on!

4 years ago

Superyacht 2030

4 years ago

The Superyacht Forum Live - Day Two

4 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek