Age vs size

We consider how two crucial metrics affect the average sales time of sole CA second-hand superyachts…

The sale of a superyacht can be a complex and time-consuming process that, at times, can be hard to quantify. With the market constantly shifting from a buyer’s market to a seller’s market and back again, the market’s cycles can make it hard to make any rhyme or reason of it. However, by exploring two key metrics – age and size – in relation to the sale of sole CA superyachts since 2015, we are able to draw a number of conclusions about the demand for certain vessels using analysis provided by The Superyacht Agency.

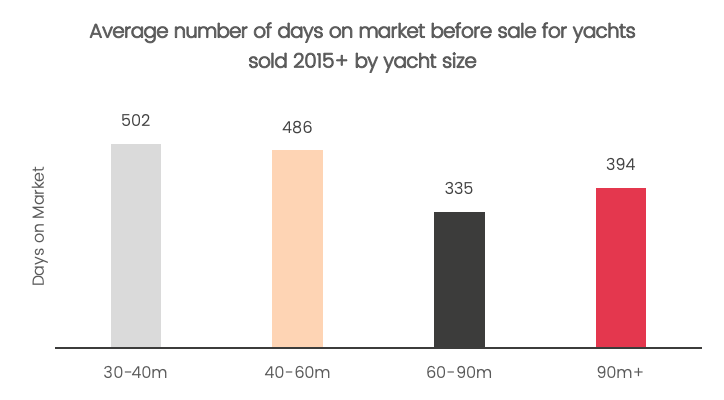

That 30-40m vessels spend the most time on the brokerage market on average (502 days) is at once surprising and unsurprising (Fig1). On the one hand, 30-40m superyachts are the most affordable of all the superyacht size ranges and by dint of this, they have the largest potential buyer pool, suggesting that the sale of 30-40m vessels would be easier and, perhaps, quicker. However, 30-40m superyachts are also by far the most numerous of all the size ranges and, therefore, their rarity is negated and competition for sales increases.

Fig1

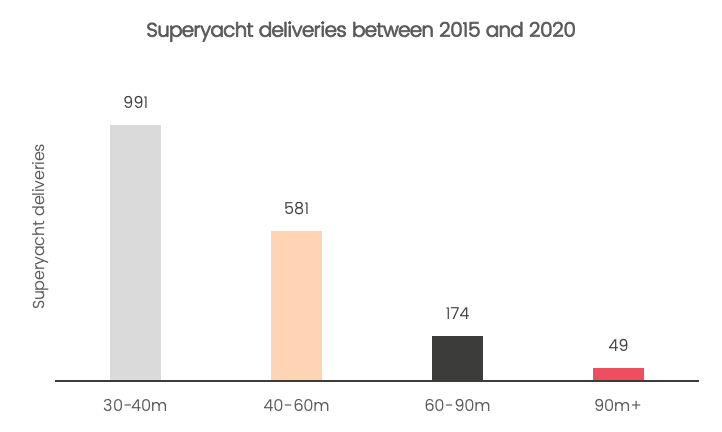

Fig2 highlights the number of deliveries across the various size ranges for the same time period analysed within the brokerage data. More than anything, this graph showcases just how numerous 30-40m vessels are compared with the other size ranges and this figure would become even more pronounced if one were to take into consideration the entire historical fleet.

Fig2

Given the issue of rarity (supply), it stands to reason that as the vessels grow in size, their time on the brokerage market will decrease, and so proves to be the case. On average, 40-60m vessels spent 16 fewer days on the brokerage market than 30-40m vessels. However, it should be noted that a 16-day average differential is nominal, to say the least. Whereas, the 151-day average difference between the 40-60m and 60-90m size ranges is of far greater consequence.

While the general trend holds that the larger the vessel the less time it spends on the brokerage market, the trend is not perfectly linear as the average time on the market increases for the 90m-plus range (394 days). It is perfectly possible to theorise as to why 90m-plus vessels typically take longer to sell: they are more expensive, they are more complex, they are generally highly customised to an individual’s tastes, buyers in this pool may prefer to build new and so on. That being said, there are so few sales of vessels of this type that an average taken across five years could vary massively between analysed periods. This lack of predictability will become clearer when age and size are analysed in conjunction with one another.

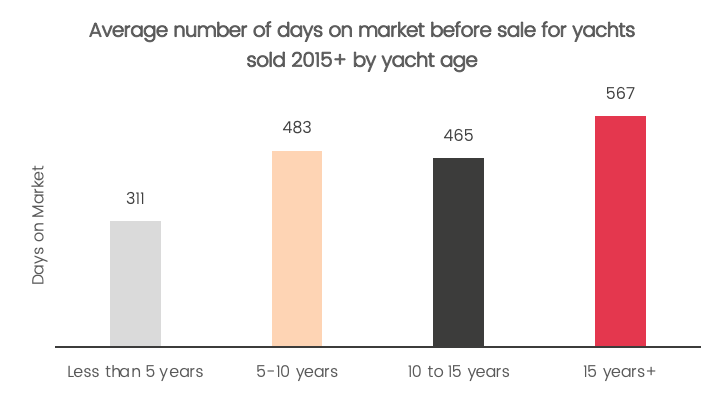

Fig3

When speaking with the brokerage community, a phrase that is often repeated is ‘new and nearly new’. This descriptor is used to highlight those vessels that are less than five years old and their persistent popularity on the brokerage market. Given lead times, shipyard slot availability and build periods at the world’s premium new build shipyards, nearly new superyachts are extremely attractive propositions for buyers across the size ranges, although perhaps less so within the 90m-plus market. This notion is highlighted in Fig3 where vessels that are less than five years old sell after less than a year (311 days) on average.

By contrast, there is little difference between the sales times of superyachts that are 5-10 years old and 10-15 years old, with only an average of 18 days separating the two size ranges. However, 15-plus-year-old superyachts, on average, spend around an additional 100 days on the brokerage market (567).

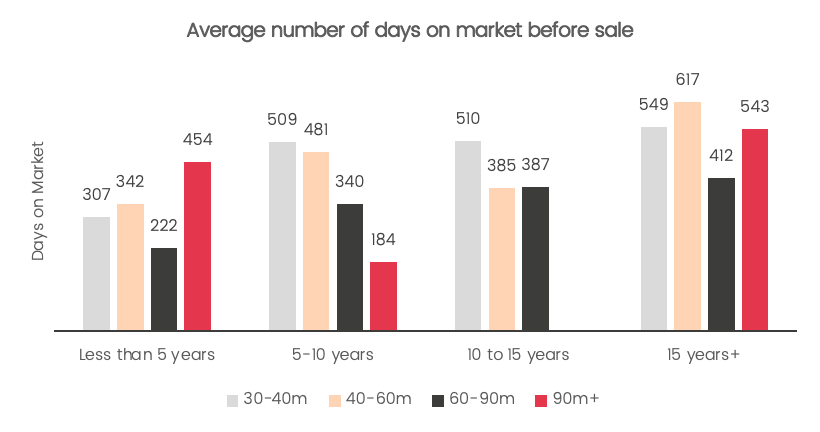

While size and age are, in and of themselves, interesting metrics to consider when applied to the brokerage market, a far more interesting picture of this vital sector is created when both metrics are applied to the second-hand fleet in conjunction. For instance, the quickest sales (aside from the anomalous 90m-plus sector) on average occur within the 60-90m range for vessels that are less than five years old (222 days). By contrast, the most time-consuming sales occur for 40-60m vessels that are 15-plus years old (617 days).

Fig4

For the most part, the analysis highlights that the older vessels are across the various size ranges, the longer they take to sell, aside from the 90m-plus sector. However, one clear anomalous result is that 5-10-year-old superyachts in the 40-60m range actually took longer to sell on average than those projects of the same size that were 10-15 years old, taking 481 days and 385 days respectively. Exactly why this proved to be the case is open to interpretation, perhaps any significant price differential between the two age categories makes buying and refitting older 40-60m vessels a more enticing proposition, or it may simply be that the period analysed herein was anomalous and unrepresentative of the market’s typical results.

From a seller’s perspective, perhaps the most important thing to note is that the age of a vessel will have the most profound impact on its ability to sell. Almost regardless of the size range, new and nearly new vessels will continue to maintain their appeal to buyer’s with a hunger for the newest products but an aversion to long build times. The difference between the sales time for less than five years and 5-10 years is the largest jump between any of the age ranges.

For more information relevant to the purchase, sale and ownership of superyachts, look out for the delivery of The Superyacht Owner Report on 24 August. Click here to gain access to the full suite of products and services available from The Superyacht Group.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

How to sell a giant

SuperyachtNews speaks with Paolo Casani, CEO of Camper & Nicholsons, about the sale of Lady Moura

Owner

Combining brokerage and financing

The team at Compleo Superyachts discusses the benefits of combining financing and brokerage

Business

Asia and North America dominate ultra-wealthy landscape

A growing UNHW population in North America, in particular, bodes well for the superyacht market's short-term growth

Business

The show must go on

Major players from the worlds of superyacht building and brokerage return to the Monaco Yacht Show

Business

S/Y Elton: ensuring a return on investment

A discussion with Andy Scott, the owner of 32m sailing yacht Elton, on running a profitable charter yacht

Owner

The Bahamas : a success story with Kaisa Pace

A well-established destination for yachts, The Bahamas has been open for tourists since June of last year

Owner

Related news

How to sell a giant

5 years ago

Combining brokerage and financing

5 years ago

The show must go on

5 years ago

S/Y Elton: ensuring a return on investment

5 years ago

The Bahamas : a success story with Kaisa Pace

5 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek