A buyer’s guide to the 70-90m motoryacht segment

A sector that was once dominated by custom Northern European shipyards is now more diverse than ever before…

In recent years the 70-90m motoryacht segment has grown significantly due to several key factors. Perhaps the greatest influence on this sector has been the natural progression of UHNWIs throughout the various size ranges in conjunction with the rapid growth of UHNW wealth worldwide. As a by-product of this continued growth, there are now more legitimate options in this size segment than ever before. What was once the purview of a select few shipyards is now a diverse and competitive sector.

Indeed, such has been the growth of the 70-90m sector, it is no longer a segment of the market that is reserved exclusively for fully custom projects. While Amels had previously delivered four 70-90m projects, the delivery of Plvs Vltra in 2016 signalled the renowned series builder’s re-entry to the sector, since which it has been a picture of consistency.

For a size sector that traditionally dominated by the Northern European custom builders, the 70-90m market has become incredibly diverse with yards from Northern Europe, Italy and Turkey represented in the top-performing shipyards over the last decade. As a buyer then, it is important to develop a clear understanding of budget, delivery dates, requirements and level of customisation.

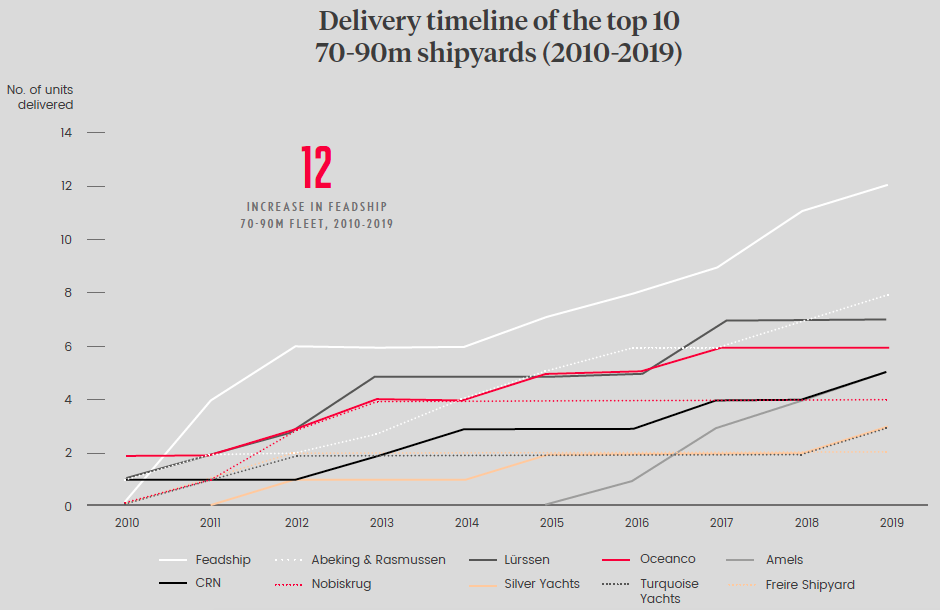

Shipyard performance, as with every sector, is always a strong indicator of a give shipyards credentials. Consistency is extremely suggestive of a number other factors including, but not limited to, quality, customer experience, expertise, financial security and client satisfaction and, over the last decade, Feadship has proved to be the dominant 70-90m superyacht builder. Lürssen, Abeking & Rasmussen and Oceanco are also worthy of mention, however, while these yards are still willing and able to build in this size range, periods of inactivity suggest that they have focussed their energies on the 90m+ market.

Amels, as previously mentioned, has proved to be a consistent series builder in this size range in recent years, perhaps suggesting that, for those owners who are less concerned with full customisation, it is the yard of choice. CRN dominates the market in terms of the Italian contingent.

Perhaps surprisingly, the rate of depreciation within this sector is actually lower than it is within many of the small size ranges. While this seems to fly in the face of common sense, what the 70-90m market has in its favour is its relative scarcity on the second-hand market. While the sector has grown rapidly in recent years, this is only true in percentage terms. In a unitary sense, the growth from three deliveries in 2002 to 12 deliveries in 2018 is small, but it can easily be represented as 300 per cent growth.

In addition, vessels in this size range are typically built to be kept for significant periods, saving the occasional unfortunate circumstance, thus increasing their scarcity and supporting their resale value. However, of those vessels in this size range that have been sold, Burgess and Fraser lead the way in terms of sales.

To find out the nuances of buying in this sector, how various shipyards have performed in recent years, depreciation rates and explore how the 70-90m sector performs on the second-hand sales market, and which brokerage houses are dominant, be sure to access your complimentary copy of A Buyer’s Guide to the 70-90m motoryacht segment and click here

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

.jpg)

77m La Datcha delivered

The SeaXplorer, part of the Tinkoff Collection, will begin its adventurous fixed itinerary charter plan

Fleet

Related news

77m La Datcha delivered

5 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek