Italian boatbuilding industry grows by 20% in 2022

2023 growth estimates also remain positive, bucking global trends…

In 2022, according to the latest studies conducted by Istat, the Italian National Institute of Statistics, Confindustria Nautica and Deloitte, the Italian marine industry increased by 20% compared to 2021, reaching a value of €7 billion. For the nautical industry as a whole, which also includes accessories and engines, revenues are expected to exceed €7 billion, up by around 15% from €6.11 billion in 2021. Final figures will be released during the Genoa Boat Show in September 2023.

This performance contrasts with the trend of the worldwide economy, which is showing signs of slowing down and is characterised by high uncertainty, with falling demand and less favourable financial conditions for both households and businesses. The international scenario is still weighed down by the uncertainty linked to the timing and outcome of the conflict between Russia and Ukraine, the risks of financial instability, and a level of inflation still far from the central banks’ targets.

The global economy is expected to slow down in 2023 and then show greater dynamism in 2024. The European Commission has revised downwards its estimates for world GDP growth, which is expected to grow by 2.8% and 3.1% in 2023 and 2024 respectively. Despite signs of slowing inflation and receding financial turmoil the main central banks are continuing to raise interest rates, albeit at a more moderate pace.

The forecast for the Italian economy is generally positive. In the first quarter of this year, after a slight drop at the end of 2022, the expansion phase of the Italian economy continued (+0.6% the economic variation), bringing the 2023 acquired growth to +0.9%. However, in May, household and especially business confidence indices worsened, interrupting the positive trend that had characterised the previous months. Consumer opinions on personal, current and future climate worsened, while those on economic climate improved. Among businesses, the sharpest drop in confidence was recorded in construction. The index components fell in all sectors with the exception of potential on orders in market services.

Italy’s leadership in the global yachting industry appears to be confirmed, with 593 orders out of the 1,200 superyachts under construction worldwide. Market and analysts’ estimates indicate prolonged development prospects. Furthermore, according to Deloitte’s market survey The State of the Art of the Global Yachting Market report, estimated growth in 2023 is expected to remain stable at between 15 and 20%, according to Confindustria Nautica.

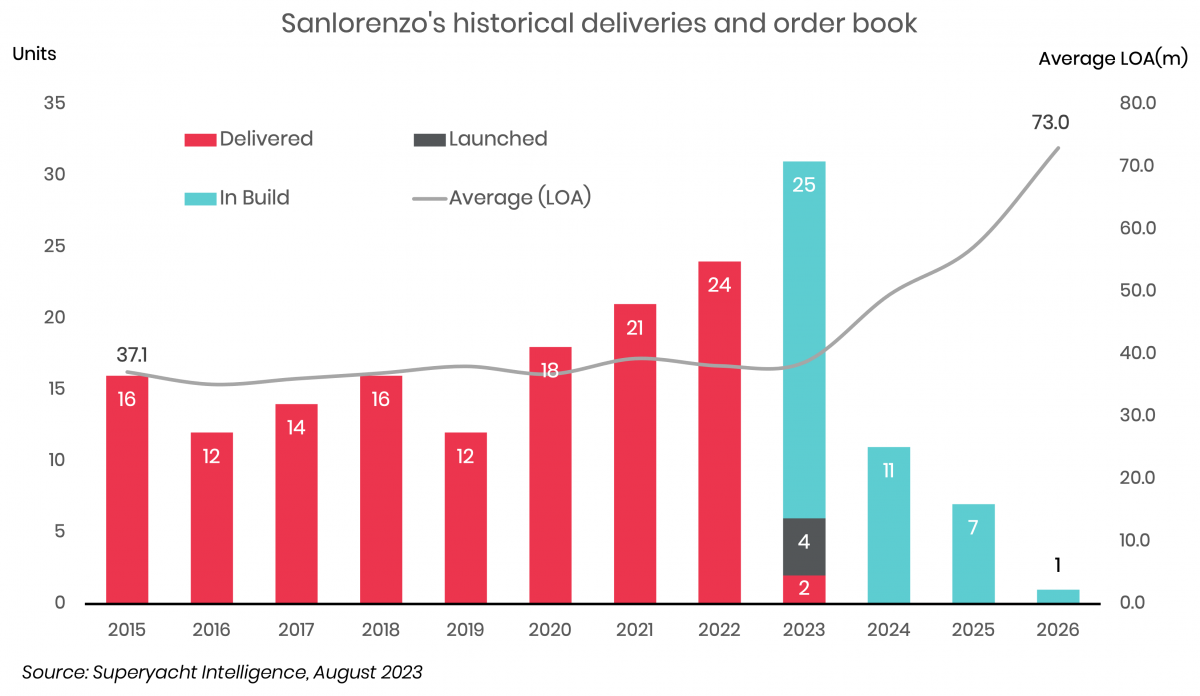

The scenario for Sanlorenzo, one of the leading international players in the market, is positive and sees excellent signs from the world market.

“The target of the yachting market is represented by ultra-high-net-worth individuals, whose number is expected to grow steadily in the medium term, with an annual increase of 24,000 to reach 385,000 in 2026 and a consequent increase in potential,” says Ferruccio Rossi, Group General Manager and President Sanlorenzo Super Yacht. “In this context, I would like to point out the impact represented by the lowering of the average age of Sanlorenzo superyacht buyers, which has gone from 56 to 48 years in just four years. This interesting phenomenon has achieved a two-fold positive result: in addition to the enlargement of the client base, the sensitivity of new young customers who demand increasingly sustainable solutions. In general, the most popular segment continues to be yachts between 30 and 40 metres. As far as we are concerned, according to the latest figures, sales revenues have affected all product ranges, in particular, the asymmetrical models of the SL line, the new models of the SD line and with an increasing incidence of the SX line and the new SP line.”

Rossi explains that although the scenario is positive, major difficulties remain and new challenges need to be addressed: “The main challenge undoubtedly concerns the sustainability aspect. We have all taken up this challenge with a pioneering spirit, and our R&D department is working hard to develop innovative technologies to make boats more sustainable in every respect. We share this goal with our partners, world-leading energy and e-fuel companies, with whom we have signed exclusive agreements to reduce the environmental impact of our ships.

“Our Industrial Plan 2023-2025 includes the introduction of new ranges with the entry into different segments, such as multihulls. In addition, following the route mapped out by the ‘Road to 2030’ strategy, the first 50Steel will be launched in 2024, making the zero-net-carbon footprint yacht during anchorage and dock time equal to more than 90% of a yacht’s utilisation. As for Bluegame, in the <24m segment, we are pursuing two innovative projects involving the use of hydrogen: the BGH tender, chosen by the New York Yacht Club as the ‘chase boat’ to accompany American Magic during the next edition of the America’s Cup; and the BGM65HH (hydrogen-hybrid), inside of which hydrogen fuel cells will be installed combined with the new generation of Volvo Penta hybrid engines, for which Sanlorenzo has been chosen as the pilot shipyard.”

Although critical aspects of the international scenario still weigh on the worldwide uncertainty linked to the conflict between Russia and Ukraine, the risks of financial instability and a level of inflation that is still far from the objectives of the central banks, the international yachting sector has shown remarkable dynamism in recent years, proving great resilience to Covid-19 and economic-financial turbulence, achieving considerable growth and the construction of an increasing number of new yachts. The trend remains positive and seems likely to continue for some years to come, as a number of yards report full order books until 2025 and potentially into 2026 too.

Profile links

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Sanlorenzo publishes Q1 financial report

Sanlorenzo S.p.A. reports strong financial performance in Q1 2023 across superyacht and Bluegame divisions

Fleet

Sanlorenzo shares 2022 financial results

Sanlorenzo has reported double-digit growth across all metrics

Fleet

Sanlorenzo plans for net-zero superyachts in 2027

Sanlorenzo's R&D and technical department engineers together with Lloyd’s Register will tackle this challenge

Business

Related news

Sanlorenzo publishes Q1 financial report

3 years ago

Sanlorenzo shares 2022 financial results

3 years ago

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek