A ‘Little Red Book’ for superyachts

Should our market borrow Facebook’s strategy to ensure we stay ahead of the curve?

The superyacht industry is often accused of being far too insular, focusing on the same pool of clients and same business stratagems that have worked for us so far. It is also true, however, that people are joining the ever-growing conversation about how to sustain our industry and ensure long-term growth. Discussions surrounding different ownership models, marketing techniques and millennial-focused designs are all gaining traction, but many in the superyacht industry are sticking to the practices that they know. Most of the inspirations for change have been driven by outside influences, such as trends in aviation or the automotive industry, so I couldn’t help but wonder, how are other sectors attempting to work out their kinks and problems in order to ensure growth?

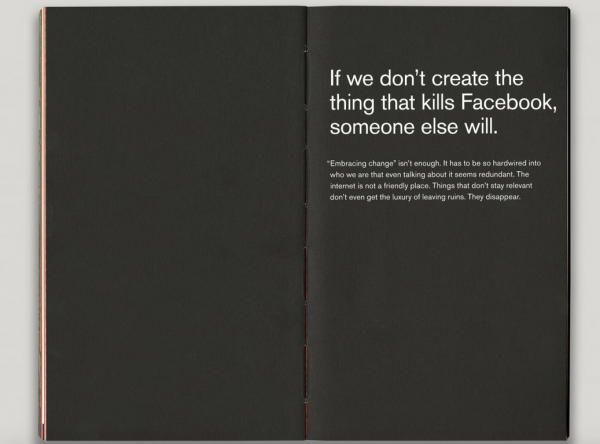

In his session at The Superyacht Forum last week, Paul Kemp-Robertson of Contagious Communications presented a business strategy utilised by Facebook. When a new employee joins the company, they are given a ‘Little Red Book’. Within its pages are various mottos, mantras and ideas, but one is especially striking: “If we don’t create the thing that kills Facebook, someone else will.”

It continues: “Embracing change isn’t enough. It has to be so hardwired into who we are that even talking about it seems redundant. The internet is not a friendly place. Things that don’t stay relevant don’t even get the luxury of leaving ruins. They disappear.” According to Kemp-Robertson, each Facebook employee is encouraged to dedicate time looking at the flaws of the company – indeed, their own product – and to try and make it obsolete.

“Embracing change isn’t enough. It has to be so hardwired into who we are that even talking about it seems redundant. The internet is not a friendly place. Things that don’t stay relevant don’t even get the luxury of leaving ruins. They disappear.”

This thinking isn’t completely new; it echoes the famous adages of Henry Ford (“If I had asked people what they wanted, they would have said faster horses”) and Steve Jobs (“You can't just ask customers what they want and then try to give that to them; by the time you get it built, they'll want something new”). What I find most interesting about Facebook’s strategy is the idea that 'embracing change isn’t enough'; those at the heart of the company are actively working to destroy Facebook.

I’m not saying that everyone in the superyacht market should start attempting to eradicate our industry. But rather than relying on following suit from other sectors, should we adopt the ‘Little Red Book’ approach from Facebook? Brokers are surely the best to know the pain points of a client’s journey, just as lawyers are aware of the problems that arise when negotiating a contract. If we understand what we are doing wrong and don’t use it to our own advantage, someone else will.

This ‘Facebook’ strategy isn’t just appearing in Silicon Valley. A recent article from the Financial Times highlighted that there is soon to be the largest transition of wealth in history; over $4 trillion between generations. This will occur when the ‘baby boomers’ will leave their vast amounts of wealth to their descendants, many of whom are millennials (classed as those born between the mid-1980s to the early 2000s). Wealth managers and financial institutions are hastily attempting to adjust their business strategies to engage with these new UHWNIs, who don’t have the same preferences or values as their parents or grandparents before them. Financial institutions have carried out extensive research into the different spending patterns and focuses of their future bosses, recognising that the traditional role of advisor, which has sustained the financial industry for years, is fast becoming obsolete. The same article outlines how a huge proportion of millennials are interested in impact investment and sustainable business practices. The focus of wealth management, as well as its delivery (not surprisingly, everything is moving online at an alarming rate) is shifting to genuinely take this ‘next generation’ and their preferences seriously, and they are achieving this by undertaking some serious self-scrutiny.

A book of aphorisms isn’t going to future-proof the market, but the sentiment behind Facebook’s ‘Little Red Book’ is one that we should explore. Let’s take the negative connotations of looking inward – only concentrating on our niche world – and use it to our benefit.

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek