Bi-weekly brokerage analysis

The first of our bi-weekly brokerage updates highlights an extremely strong start to the year for the second-hand market…

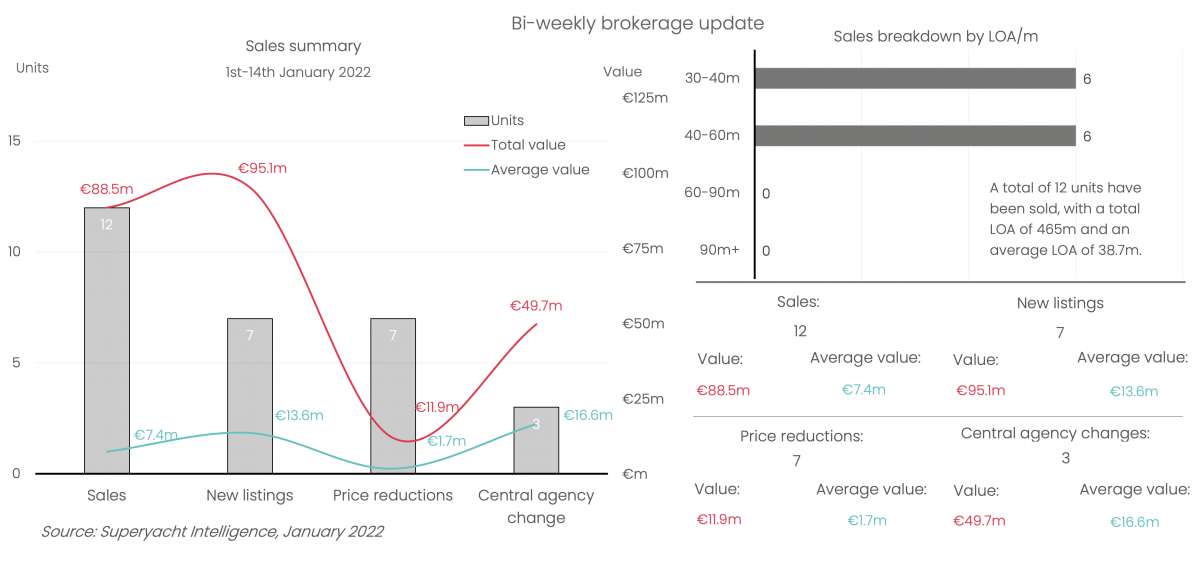

In the first of a new series of bi-weekly brokerage analysis, we explore the sector's performance over the first two weeks of the year from 1-14 January. Following on from a record-breaking year, 2022 has started as 2021 finished – strongly.

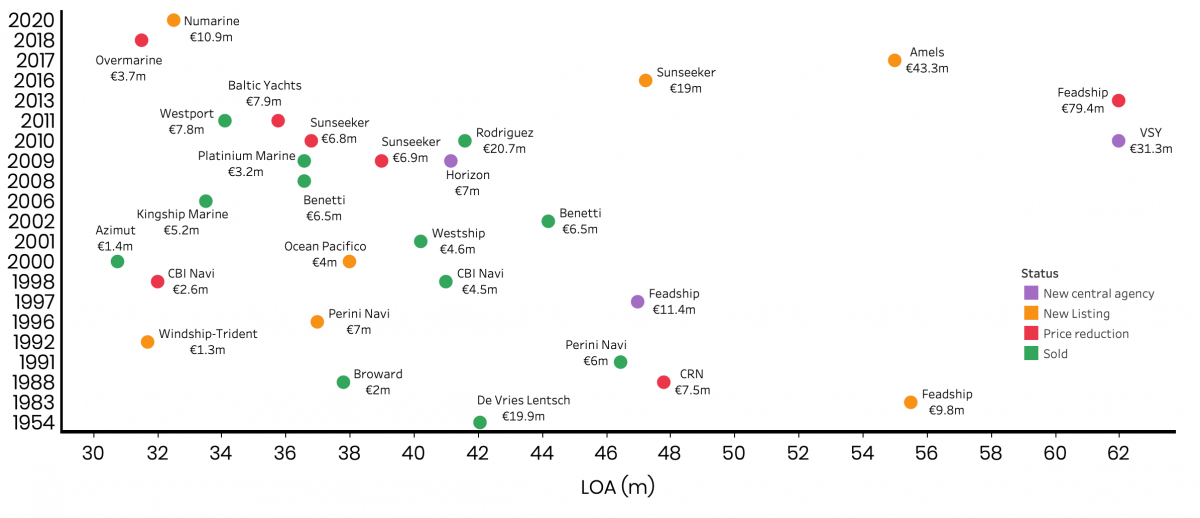

Over the two weeks analysed herein, a total of 12 superyachts have been sold for a combined value of €88.5m at an average of €7.4m, with the highest-grossing sale belonging to 42m Istros at €19,950,000. The largest yacht sold was Perini Navi’s 46.5m Piropo IV, which sold for €5,950,000. By contrast, in 2021, which by all accounts was an extremely strong year for sales, there were only 7 sales conducted in the first two weeks and 16 throughout the whole of January.

In terms of new listings, seven new superyachts were added to the brokerage fleet with a combined value of €95.1m and an average price of €13.6m. Arguably the most significant new entry to the market is Lili, the 55.5m Amels that has been listed for €43.3m. At this juncture, more superyachts are being sold than are being put up for sale which lends credence to the opinions of the various commentators that have suggested that at some point in 2022 the brokerage market will suffer from a lack of quality inventory when compared with demand. Some brokers have further theorised that this may result in price increases, but this eventuality has yet to come to pass.

As well as there being seven new entrants to the market, there were also seven price reductions across the same period. However, while there were seven reductions in total, there was only really one reduction of particular note with the 62m Feadship, Sea Owl, having its price reduced by €9.3m to €79.4m. Given that the total value of the reductions was only €11.9m it is clear to see how significantly the Sea Owl alteration has impacted this metric.

In addition to the sales, reductions and new listings, there have been three central agency changes, the most significant of which is 62m Sealyon being jointly listed for sale with Y.CO and Northrop & Johnson with an asking price of €31.3m.

Above graph highlights all the movements within the brokerage market for the period analysed herein with green dots representing sales, red price reductions, orange new listings and purple new central agencies.

The data provided within this article is just a snapshot of the data curated and available to The Superyacht Agency through its intelligence and consultancy offerings. By breaking down the data into more nuanced metrics and overlaying it with independent data sets, all of a sudden the market can be viewed in a much more colourful and detailed manner, enabling data to become intelligence and inform business-critical decisions. To find out more about how The Superyacht Agency can help your business, click here.

Profile links

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek