Yachting is slowest growing luxury sector, says study

Bain & Company's Luxury Goods Worldwide Market Study positions yacht sales as the slowest to grow behind design, cars and fine wines. Is this good or bad news? Luxury and yacht commentators give their perspective on the Mitt Romney founded company's analysis.…

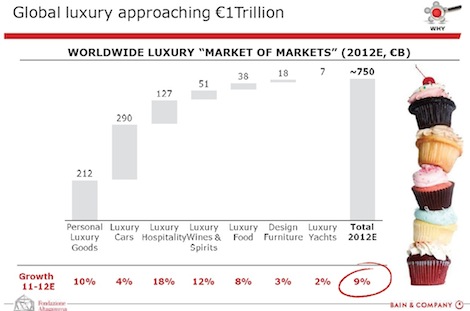

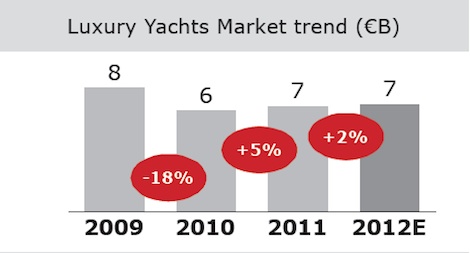

Bain & Company’s Luxury Goods Worldwide Market Study, based on brands reporting numbers at end of third quarter of 2012, has predicted what the year-on-year growth of seven different luxury sector’s sales will be. Measuring the sales of yachts, defined as any vessel valued at €15 million and above, it identifies growth of just 2 per cent compared to 2011.

This makes it the weakest performing sector, behind design furniture at 3 per cent and luxury cars at 4 per cent, with luxury hospitality and fine wines at the top end of the spectrum at growth rates of 18 and 12 per cent respectively.

The study’s conclusions behind these sectors' slow performance, in the context of what is a phenomenal overall growth rate for global luxury sales (up 9 per cent on 2011 to €750 billion) are however, somewhat black and white, belying what the industry sees as a more complex reality.

'Luxury maintains strong global fundamentals in all segments, although performance differs by brand and market in a landscape of economic uncertainty. High-ticket categories (cars, yachts, design) strive to grow in line with previous years,' the report states.

This sentiment is backed by David Friedman, president of Wealth X, who said:

“For the U.S, the reputational risk is, I believe, still one of the important factors hampering sales. With the re-election of Obama and a mandate to tax the ultra-rich, the climate of sensitivity around displaying wealth has become heightened.”

But James Lawson, director at Ledbury Research finds the percentage much less worrying, and symptomatic of the usual way of things in the luxury sector:

“The high-ticket-cycle has bigger peaks – higher highs and lower lows. This is true across the luxury landscape. For example, in the past four years, the watch and jewellery sector saw growth ranging from +29 per cent to -28 per cent; the lower prices accessories saw swings from +22 per cent to –7 per cent.”

And Ellie Brade, in The Superyacht Annual Report, argues the slower growth rate seen in orders for new builds is actually indicative of health:

“[Previously] order numbers were actually outweighing the delivery numbers: in other words, yachts were being ordered faster than we could build them. Now these numbers are closing together it shows that the much-needed stability is now close to being reality, and with that stability we are given the platform for growth that will allow us to maintain…continuous growth.”

Of added use and interest in seeing how yachts perform in the broader context of the luxury landscape, is the high growth rate for consumers seeking ‘rare and rewarding experiences.’ In the luxury hospitality sector, the continued high growth rate of 18 per cent for 2012 and 15 per cent for 2011 is underpinned by:

“The global hunt for “bling” by luxury travellers evolving into a desire for rare and rewarding experiences.”

This trend for unique experiences is positive for the charter market, believes Tom Chant of Superyacht UK.

“It’s relevant that hospitality is up – if they’re willing to buy Necker island for the week they can probably buy a yacht charter. And that is quite an important feed into the (first purchase) market.”

Often the performance of superyacht industry is viewed in its own bubble, impossible to be analysed against lower cost and more easily accessible items such as fine wines, or practical purchases such as jets. Whilst the industry is unique, the study is interesting as an objective overview of patterns seen in top tier spending as well as offering encouragement from the robust overall growth of luxury sales.

Related Links

Bain & Company's Luxury Goods Worldwide Market Study can be accessed by contacting the company

The Superyacht Annual Report can be downloaded or ordered here

A Market for New Clients: ways to draw in new clients, will be one of the session topics at the American Superyacht Forum, Las Vegas (14 to 16 May)

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek