Carbon pricing explained

Carbon tax is a way to pay for emissions, but what is its future within the maritime and superyacht sectors?

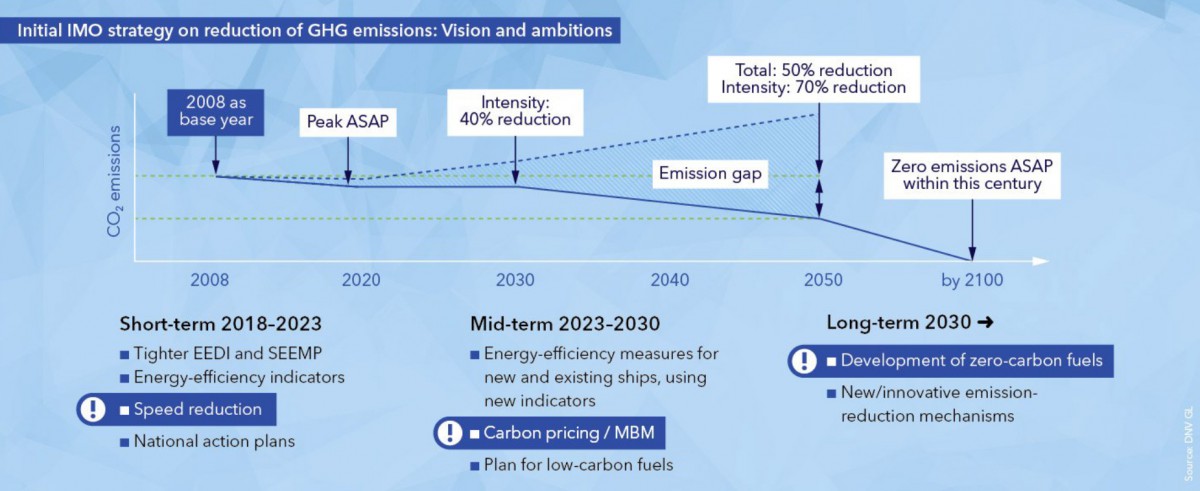

By the end of this year the International Maritime Organization (IMO) will decide on a carbon-pricing policy that will affect the global maritime industry. This is part of the mid-term efforts within the IMO’s updated greenhouse-gas-reduction strategy agreed upon last year and the superyacht industry has not evaded the crosshairs of the proposed legislation.

Once agreed, this new policy will be adopted by the IMO in autumn 2025 and will come into force in 2027.

Alongside this, the EU has two different carbon-pricing schemes that will affect shipping in the next couple of years. One of these, the EU Emissions Trading Scheme (ETS), has applied to shipping since 1 January 2024 and will affect a small segment of the superyacht fleet. Malcolm Jacotine, captain and consultant, sought clarification from the European Commission, which confirmed it will specifically be applied to those yachts that are above 5,000gt and are transporting passengers for commercial purposes (charter) and performing voyages.

These different efforts are probably what the American Bureau of Shipping chairman and CEO Christopher J. Wiernicki was talking about during an appearance at the CERAWeek energy conference (the ‘Davos of energy’) in March this year. He stated, “A universal, global carbon tax on shipping is coming, as alternative blue fuels made with carbon capture emerge as a critical step in the energy transition at sea.”

ETS is supported by the EU’s Monitoring, Reporting and Verification (MRV) system. Under MRV, vessels will need to keep records of their different GHG greenhouse gas emissions from vessel voyages included within its scope. Initially affected vessels will need to purchase EU Allowances (EUA) to cover half of their greenhouse gas emissions to and from EU, Norwegian and Icelandic (EEA) ports, and all emissions for intra-EEA voyages and while at berth at EEA ports.

In 2025, 40 per cent of the CO2 emissions from voyages and at berth stays in 2024 will be subject to the ETS, ramping up to 100 per cent in 2027. In 2026, this will also include 100 per cent of the carbon equivalent of other greenhouse gas emissions, methane and nitrous oxide.

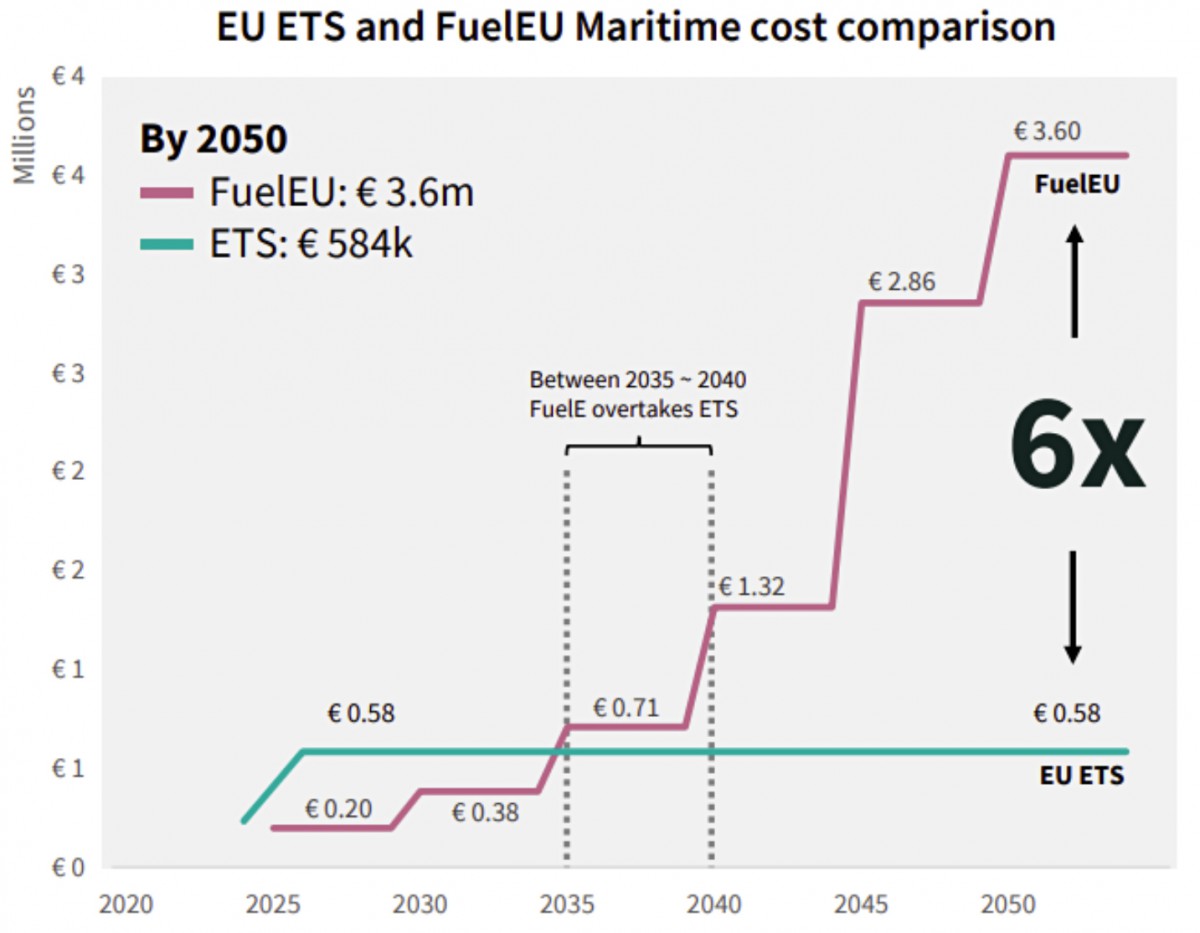

The other mechanism affecting commercial vessels is FuelEU Maritime, which also applies to vessels above 5,000gt, will come into effect in 2025. This sets targets for reducing the yearly average greenhouse gas intensity of the energy used by vessels. This starts at -2 per cent in 2025, reaching -6 per cent in 2030 and -14.5 per cent in 2035 through to -80 per cent by 2050. Similar to ETS, there will be a financial incentive to comply and over-achieve on emission reductions, as penalties and rewards will be issued based on performance relating to these targets.

Analysis by Lloyd’s Register reveals that by that stage the financial impact of FuelEU Maritime could already have overtaken that of the EU ETS. By 2050, FuelEU penalties could cost six to eight times more than the cost of buying EUAs.

The IMO is currently developing a framework to determine carbon pricing for the maritime industry. Multiple options are being explored to determine the type and amount of this carbon pricing. Proposals range from a global shipping cap-and-trade system, similar to the EU ETS (advocated by Norway) to a carbon tax-like mechanism proposed by three different interest groups (Japan, Marshall Islands and Solomon Islands, and the International Chamber of Shipping). It is estimated this policy could raise more than £80 billion a year in funding, which could be used to further develop or subsidise low-carbon shipping fuels.

Wiernicki commented on the potential interlinking of these two systems: “Despite IMO and EU regulations surrounding this being separate, I believe you will see a universal carbon tax emerging as the IMO and the EU will sync together.” However, if these do not sync up and the IMO cannot agree on a global emissions price by 2028, the EU has suggested it may bring more international shipping emissions into the EU ETS.

“Commercial gravity alone will not get us to net zero by 2050. We will need ambitious measures, both carrot and stick.”

Carbon-pricing systems are nothing new. According to the World Bank, 68 direct carbon-pricing instruments were operating as of June 2022 in 46 national jurisdictions around the world. These comprise 36 carbon tax regimes and 32 emissions trading systems (ETS).

For clarity here are the explanations of the two mechanisms of implementing a carbon-pricing system.

Carbon tax: A levy applied to the direct production of GHG emissions or fuels which emit these emissions. So those who use fuel will need to pay more; this will also increase the price of the price of products with higher associated emissions.

Emission trading systems: This involves setting a maximum level of pollution that organisations are allowed to emit, and anything above that amount will need to be allowed through the purchasing of emission permits. The price of permits fluctuates depending on the level of supply and demand of these.

The most well known is the EU ETS introduced in 2005, which initially affected power stations and industrial plants, and has a current cost of €64t/CO2. From 2005 to 2015, emissions from sectors covered by the EU ETS decreased. However, the IMO carbon price is set to be much higher, with some proposals suggesting $150 per tonne of greenhouse gas emissions. This cost will be passed on from emitting sectors affected by this such as fuel suppliers to its customers.

In 2021, around 6 per cent of emissions were in countries or sectors that had a carbon tax. Some 20 per cent were covered by a trading system. This means that, in total, a carbon price had to be paid on 26 per cent of global emissions.

Christopher J. Wiernicki, chairman and CEO, American Bureau of Shipping

So these are the different forms of carbon pricing that through their mechanisms will begin to apply a financial benefit to those who emit less. As Wiernicki says, “Commercial gravity alone will not get us to net zero by 2050. We will need ambitious measures, both carrot and stick.” These carbon-pricing systems act as the carrot and stick necessary to drive the maritime industry to change. Currently, these will only affect a small sector of the superyacht industry subsection of the maritime industry; however, this is still an uncertain and rapidly changing area of regulations and legislation.

For example, later this year, the commission will assess whether additional ship types, and those from 400gt to 5,000gt, should be included within the MRV part of the ETS system. Given the continued spotlight on the superyacht industry and its emissions, as seen in another recent protest in Ibiza where activists targeted 103-metre Blohm+Voss yacht Lady Moura, this will contribute to the wider pushes for the industry to face more environmental regulations, and so these systems could affect a larger segment of the superyacht fleet and potentially associated businesses in the future.

As Wiernicki said, there is “much still to be decided in the coming decade of change … the next 10 years will determine what is desirable vs what is doable.” The same aspects that will be determined for the wider maritime sector, driven by “the boundary conditions of safety, fuel availability and scalability of infrastructure and, more specifically, by the cost of the electrolyser and the cost of the carbon capture” will influence the superyacht industry’s own transition.

This potential future legislation, fluctuating carbon price and its further effects should act as yet another reason for the industry to accelerate its efforts to provide lower-emitting new yachts and to generate and implement improvements to current yachts in the fleet.

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

Related news

Sunreef sends message in a bottle

The Polish shipyard has introduced a new eco-conscious construction method that will incorporate recycled material into the yacht structure

Fleet

Are yards doing the hard yards?

Are new-build shipyards doing enough to improve their in-house sustainability processes as the clock ticks down to the looming deadline of 2030?

Crew

Green hydrogen arrives in Monaco

Yacht Club de Monaco and SBM Offshore have launched a platform to provide green hydrogen in Monte Carlo part of a ‘responsible yachting’ initia

Crew

The blue carbon investment

Last year was the hottest on record for the world’s oceans, so how can blue carbon initiatives from the superyacht community help protect them?

Opinion

-(3).jpg)

Crew guidelines go green

The superyacht industry has introduced technical solutions for energy transition, but changes in on-board practices are equally important

Crew

Related news

Sunreef sends message in a bottle

2 weeks ago

Are yards doing the hard yards?

2 weeks ago

Green hydrogen arrives in Monaco

2 months ago

The blue carbon investment

3 months ago

Crew guidelines go green

3 months ago