SOx changes adding fuel to the fire?

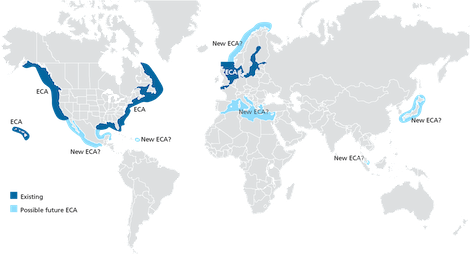

Change to emissions regulations, set to affect the choice of fuel carried by commercial ships in Emission Controlled Areas from January 2015, could cause a spike in the price of marine gas oil says one bunkering provider. This is a burden, the company says, which could eventually be shouldered by the superyacht fleet.…

While the 0.10% m/m limit will not affect superyachts, it will impact upon the commercial fleet, in terms of the composition of fuel used. Many vessels operating in these areas will be required to switch to a significantly lower sulphur fuel, such as the marine gas oil (MGO) used by the superyacht fleet.

Commenting on the impact of the incoming changes on the Ship and Bunker website, Dynamic Oil Trading’s CEO’s, Lars Møller said, "The only way to avoid the risk of an impact on operations or the risk of non-compliance with the 2015 ECA standards is to prepare now… There is uncertainty across the entire industry over the impact of the new sulphur regulations, but this can be managed and the costs can be mitigated through a proactive approach to planning ahead and by working with fuel [suppliers].”

SuperyachtNews.com was contacted by Dan-Bunkering, which has recently established a superyacht-specific operation in Monaco, about this issue. Yacht fuel trader, Rory Spurway explained that the demands being made of the commercial fleet will reverberate around the supply chain, with the result being an initial rise in the price of MGO, a factor that will affect the superyacht fleet.

The Monaco operation’s MD, Jesper Møller Christensen said the sheer number of merchant vessels that would be forced to comply with the changes would “significantly increase demand”. “Everybody knows that they will have to pay significantly more”, he added, “and the guys buying low-sulphur, heavy fuel of around six hundred and fifty or seven hundred dollars a tonne will have to pay a thousand dollars a tonne for the MGO coming in in January.”

Christensen clarified that January’s changes will not lead to a cataclysmic fuel shortage; he does however think it will have price implications for bunkering in 2015.

In theory, hedging bets on fuel price increases would seemingly appeal to management companies and charter fleets who could then offer it to all yachts under their auspices. But according to Peninsula Petroleum’s Richard Peacock, this well-established commercial model doesn’t work when applied to yachting.

“Yes, there will be a trickle-down price change but, the yachting industry being what it is, I don’t think it will be such a huge economic adversity”, Peacock explained. “It’s a great idea to hedge – we’ve looked at it in-depth – but we’ve found it really, really difficult. A million litres of fuel for a million pounds might sound like a lot of money to your or me, but when it comes to trying to hedge something, it’s actually quite small.”

Christensen said he felt the reason hedging had yet to be applied to the superyacht industry was because of its complexity. Prices, he added, would be hedged against those found in the recognised ports, with requests from smaller locations linked to these figures.

Profile links

International Maritime Organization (IMO)

NEW: Sign up for SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.

NEW: Sign up for

SuperyachtNewsweek!

Get the latest weekly news, in-depth reports, intelligence, and strategic insights, delivered directly from The Superyacht Group's editors and market analysts.

Stay at the forefront of the superyacht industry with SuperyachtNewsweek