Getting the act together: the Insurance Act 2015

The Insurance Act 2015 comes into force in August 2016 and will have real implications for commercial insurance and is likely to affect some yacht insurance policies. Simon Bowen, compliance officer at Pantaenius UK, explains what the Insurance Act 2015 is and what its key developments are.…

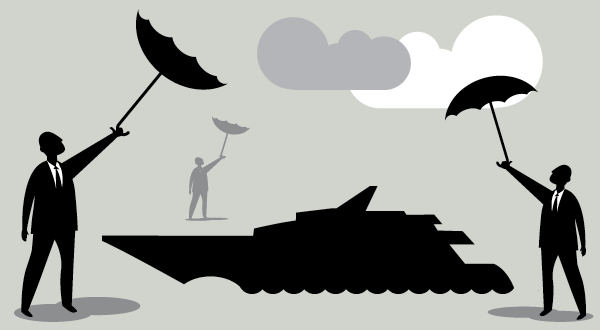

The Insurance Act 2015 comes into force in August 2016 and will have real implications for commercial insurance. Although insurance matters are not exactly the most exciting aspect of yachting, owners may wish to be aware of this legislative change, as it will affect the commercial non-consumer insurance market and therefore is likely to affect some yacht insurance policies. Simon Bowen, compliance officer at Pantaenius UK, explains what the Insurance Act 2015 is and what its key developments are.

For over a century the English law that governs insurance has been rooted in the Marine Insurance Act 1906, which codifies principles established in the 18th and 19th century. While the Marine Insurance Act appears on the face of it to cover only marine insurance, most of the principles presented in this act have been applied to all areas of insurance in English law.

Both business and consumer practices have moved on significantly in the last 100 years. More recently, this has prompted a review of the legal framework that governs both consumer and commercial insurance. In 2006 the Law Commission in the UK were asked to review the laws relating to insurance to determine whether the law remained fit for purpose. This resulted in a series of recommendations and proposed changes, which has resulted in two new pieces of legislation.

Following research and reporting on pre-contract and disclosure insurance law, the UK’s Law Commission made a series of recommendations relating to consumer insurance law. Following their suggestions, new legislation for consumer insurance contracts was implemented; The Consumer Insurance (Disclosure and Representations) Act 2012, which came into force in April 2013.

The Insurance Act 2015 is the second piece of legislation that stems from this review. Coming into force in August 2016, it incorporates a number of the Law Commission’s recommendations to rebalance the laws that relate to commercial insurance.

Where the Consumer Insurance (Disclosure and Representations) Act 2012 provides a greater level of protection for the consumer purchasing personal insurance, the new Insurance Act 2015 extends much of this legal protection to business and other non-consumer insurance. Both the Consumer Insurance (Disclosure and Representations) Act 2012 and the Insurance Act 2015 are therefore broadly good news for the superyacht owner. But what are some of the key developments that the Insurance Act 2015 will bring?

The duty of fair presentation

Under the Marine Insurance Act 1906 the legal principle of ‘utmost good faith’ is central to insurance contracts and pre-contract disclosure, imposing a clear duty on the insured to answer questions honestly, carrying potentially very wide penalties if there is a failure on the insured’s part to meet this duty. This principle has been updated by the Insurance Act 2015 and will require that the insured has a duty to provide a ‘fair presentation of the risk’, which is described as the “disclosure of every material circumstance which the insured knows or ought to know, or … gives the insurer sufficient information to put a prudent insurer on notice that it needs to make further enquiries”. This places an increased obligation on insurers to make their own enquiries and is the significant change that the Insurance Act 2015 introduces.

This is relevant for Yachts owned through a limited company, partnership or in another non-consumer capacity as many superyachts are. If insured under UK law, there will be changes to the law that governs the insurance policies covering these risks. This has the potential to apply to both charter vessels and those used privately.

Yacht owners that are insured in this non-consumer capacity therefore may wish to be aware of these developments, as next year they may see some changes to the questions that are asked by insurers when taking out policies and renewing insurance policies.

Warranties

Warranties are used by insurers to manage the risk and ensure they are liable for risks in line with the promises made by a policyholder. Warranties have proved controversial and, under review, have arguably not been well understood by customers. The Insurance Act 2015 looks to update the law on warranties in insurance contracts, incorporating a number of legal precedents that have been established since the Marine Insurance Act was passed in 1906. The change to the law on warranties seeks to redress the historical imbalance and make it more equitable between the insurer and the insured, particularly tightening up when insurers can and cannot rely on warranties. Warranties are applied to and will continue to be applied to a number of aspects of yacht insurance policies and can cover a variety of risks, including for example; racing, charter or crew arrangements.

Fraudulent claims

The current law on fraud is fairly clear, but the Insurance Act 2015 adds additional clarification. The Act also indicates that remedies to fraud are universal and apply to consumer and non-consumer insurance contracts.

Communication is the key

As these changes develop in the insurance market over the coming years, it will remain imperative that yacht owners continue to have a good strong and constructive relationship with their insurance provider, so that there are no misunderstandings leading to gaps in appropriate insurance cover.

Click here to become part of The Superyacht Group community, and join us in our mission to make this industry accessible to all, and prosperous for the long-term. We are offering access to the superyacht industry’s most comprehensive and longstanding archive of business-critical information, as well as a comprehensive, real-time superyacht fleet database, for just £10 per month, because we are One Industry with One Mission. Sign up here.